Job-Related Graduate Course Certification Information

As a general rule, graduate level educational assistance paid to or on behalf of an employee that is not awarded as part of the university's Tuition Assistance Program is considered taxable income to the employee. Tax may be avoided if the education is job-related and meets the working condition fringe benefit exception for education as defined by Treasury Regulation 1.162-5 (see below). IRS Publication 970, Tax Benefits for Education is also helpful to review (chapters 11 and 12).

If you wish to claim the working condition fringe benefit tax exemption, university policy requires the completion of the Job-Related Graduate Course Certification Form (see below) each semester. Please complete the form in its entirety, providing responses to all questions as completely as possible and email a PDF copy of the final, signed form to Tom Peifer, 105 JH for review by the Controller’s Office. Once the review is complete, the Controller’s Office will let you know if the courses are determined to qualify for the working condition fringe benefit tax exemption. For courses that do not qualify for tax exemption or for which the form has not been submitted, the tuition expense paid by the university will be included as part of your taxable compensation and subject to withholding.

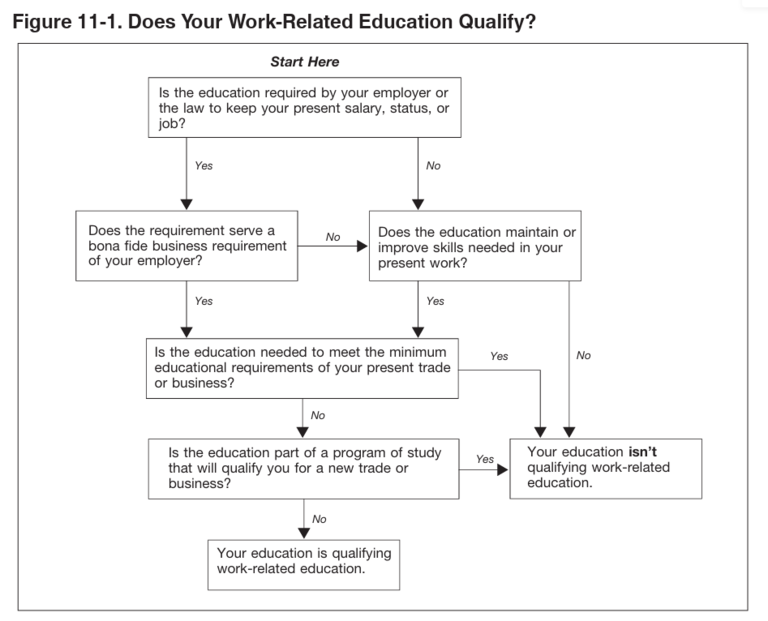

The chart below was taken from IRS Publication 970 and summarizes the requirements that must be met in order to qualify as work-related education. For a text based version of the chart, see the text outline of Figure 11-1. Does your work-related education qualify?

Text outline of Figure 11-1. Does your work-related education qualify?

Text outline of "Figure 11-1. Does your work-related education qualify?"

Question 1: Is the education required by your employer or the law to keep your present salary, status, or job?

- If yes, proceed to question 2.

- If no, proceed to question 3.

Question 2: Does this requirement serve a bona fide business requirement of your employer?

- If yes, proceed to question 4.

- If no, proceed to question 3.

Question 3: Does this education maintain or improve skills needed in your present work?

- If yes, proceed to question 4.

- If no, your education is not qualifying work related education.

Question 4: Is the education needed to meet the minimum educational requirements of your present trade or business?

- If yes, your education is not qualifying work related education.

- If no, proceed to question 5.

Question 5: Is the education part of a program of study that will qualify you for a new trade or business?

- If yes, your education is not qualifying work related education.

- If no, your education is qualifying work-related education.